Multi-Unit Franchisee | Issue 1, 2023

Multi-Unit Franchisee | Issue 1, 2023

36

As the U.S. economy emerges from the impacts of the Covid-19 pandemic, multi-unit operators have been thrown into the spotlight as franchise development shifted to focusing on experienced operators over onboarding new talent.

Two Septembers ago, in the midst of what some describe as the most severe worker shortage since the Second World War, Paul Booth Jr.’s company took ownership of its first Ace Hardware store.

When Aaron Zucker and Aaron Fields converted a former Kentucky Fried Chicken into an American Family Care in Fuquay-Varina, North Carolina, the running joke around town was that all the entrepreneurs had to change was the sign from KFC to AFC.

a franchise in one of these states, we will not o er you a franchise unless and until we have complied with applicable pre-sale registration and disclosure requirements in your state. New York State Disclaimer: This advertisement is not an o ering. An o ering can only be made by prospectus filed first with the Department of Law of the State of New York. Such filing does not constitute approval by the Department of Law. CALIFORNIA

©2023 Tropical Smoothie Cafe, LLC, 1117 Perimeter Center West, Suite W200, Atlanta, GA 30338.

08 MU PROFILE

SUDESH SOOD

On the road to 200 with 5 brands

12 MU PROFILE

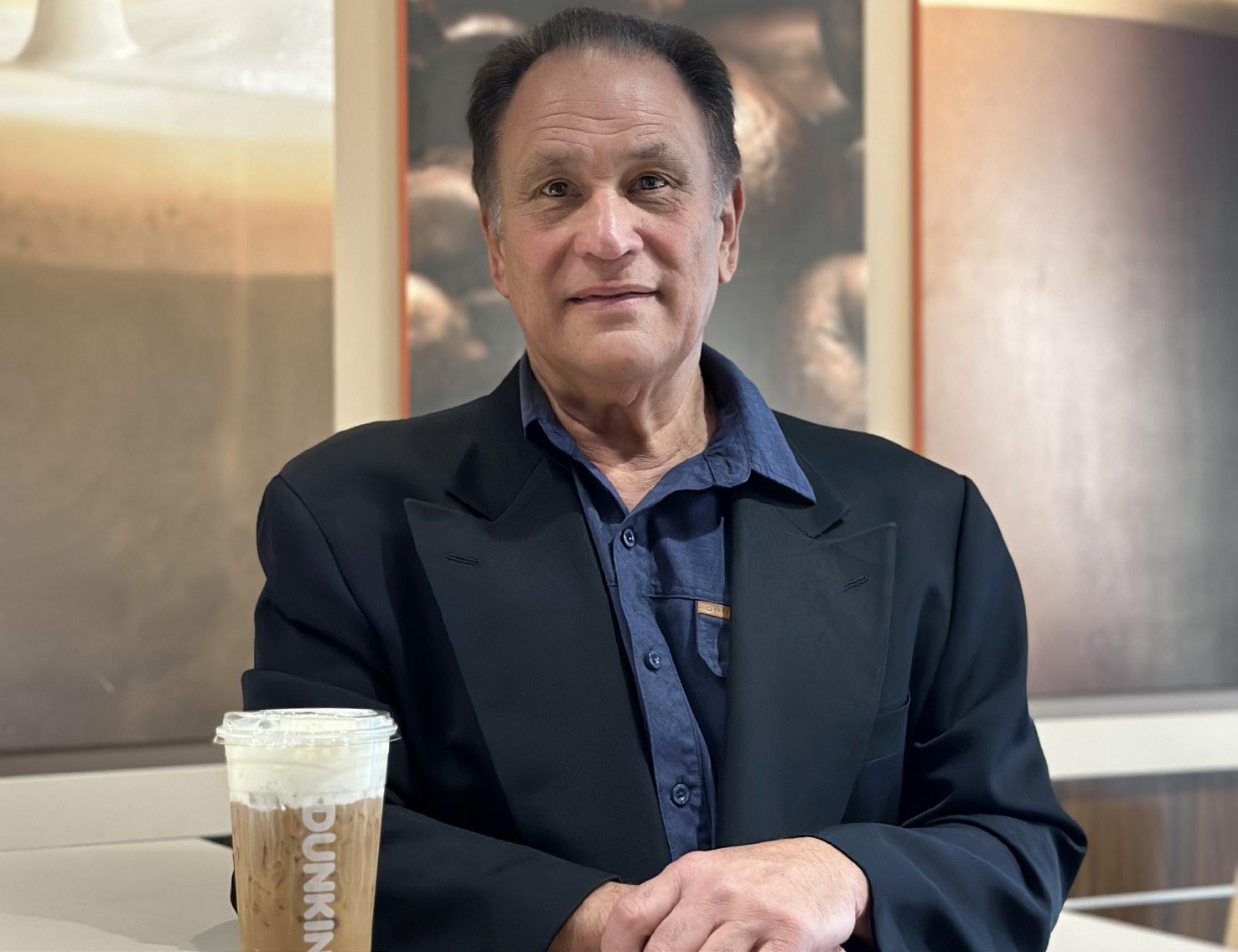

ROBERT RODRIGUEZ

Targeting $1 billion in annual revenue

18 MU PROFILE

HELEN MARTIN

Building a portfolio while helping fellow franchisees

20 MU PROFILE

DALE MULVEY 74 McAlister’s + 8 Moe’s = $120 million

26 MU PROFILE

Ex-Wall Streeter builds a new kind of portfolio

30 MU PROFILE TRACY BOUWENS

Scooter’s Coffee’s largest franchisee shoots for 100 36 RANKINGS MEGA 99

Top U.S. franchisees ranked by total number of units 44 FEATURES

LABOR MANAGEMENT

Finding, hiring, and retaining the best in 2023 52 FEATURES CONVERSIONS, ANYONE? New uses for old spaces are on the rise 60 COLUMNS CUSTOMERS COUNT Make 2023 your best CX year ever! 62 COLUMNS PEOPLE

Gig work for hourly employees trends upward

64 COLUMNS

IFA LEGISLATIVE UPDATE

Legislative threats to franchising abound in ’23 66 COLUMNS FINANCE

Set goals, build a team, and get results 68 COLUMNS

INVESTMENT INSIGHTS

Lessons from 2022 to remember in 2023 70 COLUMNS EXIT STRATEGIES

Navigating 2023’s difficult transaction environment 72 COLUMNS MARKET TRENDS

I hope you and your families have had a peaceful and healthy holiday season. On the horizon is what I call “conference season.” It’s that time of year when numerous conferences and meetings are scheduled for us to attend. As I reflect on the past, it’s become apparent that the 80/20 rule also holds true for conferences and meetings. I get 80% of the value from 20% of the conferences I attend during the year. So if I attend five conferences during the year, one of them will provide 80% of my learning, ideas, and opportunities. The Multi-Unit Franchising Conference is that one!

Like many of you, as I try to improve the performance of my business, I am constantly at battle with working on what is important versus what is urgent—always striving to focus on those activities that provide the most bang for the buck, my “high-payoff activities.” Attending any conference is time-consuming, but in the long run my attendance at the MUFC has always provided me with significantly valuable returns.

Attending the conference has provided me with the unique opportunity to make personal and meaningful connections with today’s thought leaders in franchising, to stay connected with my friends and colleagues, and to build new relationships. I’ve gained and shared new ideas and best practices through the educational tracks, where high-performing franchise entrepreneurs share their experiences in facing today’s challenging environments, gaining irreplaceable knowledge and information that I have applied to improve my business.

At the conference, you will have the opportunity to explore the many resources that are available to help run your business more productively and efficiently. There is no other place I know where so many suppliers and vendors gather to share their products and services with franchisees. You will also learn what your competitors are doing and what you can do to set your company apart.

This year’s MUFC will also bring together the latest trends and opportunities in franchising. Whether you are looking for an established brand or a breakthrough concept to grow your business for the future, you will find it there.

Whether you are a first-time attendee or a veteran, the MUFC will revitalize and reenergize you and your team. You’ll come back with knowledge and insights and ideas to move your business forward for the future. And you’ll have made meaningful connections that will last a lifetime. Attending the conference is without a doubt a high-payoff activity. I look forward to seeing you soon!

GARY ROBINS

As many have done before him, Sudesh Sood came to franchising because he wanted to do something on his own. He arrived in the U.S. after several years in the United Kingdom, where he’d built a successful career as an accountant. But something was missing.

His first job in the U.S. was in management with a large corporation, but that wasn’t working for him. Then he spotted an advertisement for a Jack in the Box franchise location. Between what he could gather from selling his house in London and a fortuitous loan from a small local bank, that first franchise was his.

Today, as president of Warner Food Management, with 180 locations across five brands, Sood’s philosophy is the same as when he started out: Work honestly, work hard, stay hands-on, and look for opportunities. His latest expansion move is an exclusive partnership in California with Noodles & Company. He’s formed a new company, NorCal Noodles, to develop 40 locations in the next 12 years.

Although his successful foray into franchising shows no signs of abating, Sood says, “I am not afraid of unplugging when needed so I can spend quality time with my family.” He credits his wife as “the secret behind my success. She is my number-one supporter and has always encouraged me to follow my dreams and pursue my passions.”

First job: Accounting clerk.

Formative influences/events: While working in London, I noticed many people visiting from the United States. After listening to their success stories, I decided to move to the USA to achieve similar success in this promised land. I was always hunting for opportunities to better myself and achieve my childhood dream.

Key accomplishments: From my first job as an accounting clerk to CFO of a multidepartment store in London, I’m now an entrepreneur with ownership of 180 restaurants here in the U.S. and now looking to venture into hotel development.

Biggest current challenge: Like most restaurant operators, we are facing the challenges of hiring, along with the economic inflation in every industry.

Next big goal: We hope to continue to grow in the restaurant space and surpass 200 locations in our portfolio. The next goal is expanding into the hospitality industry and developing quality hotels.

First turning point in your career: When I was selected to be a franchisee of Jack in the Box. Given the opportunity to grow with the brand, the acquisition was the best decision of my career.

“We always keep our employees and their well-being top of mind. We diligently find ways to improve benefits. ”

Best business decision: To put my trust in the right people. In addition to getting my family involved, I found the right business partners—Ben Nematzadeh and Eddie Nieves—along with the long-tenured administration staff who are with me today.

Hardest lesson learned: It’s exciting to grow your business, but not too quickly. Expanding too quickly in different states was the hardest lesson for me. I had to make the difficult decision to pull out of those opportunities and refocus my expansion strategy.

Exercise/workout: Five days a week.

Best advice you ever got: Work hard, be honest, and stay within your means.

What’s your passion in business? Hospitality and food has always been my passion, and has been for the last 40 years! I enjoy what I do and can’t wait to do more.

How do you balance life and work?

There is no perfect work/life balance, but I prioritize my health and I love my job. I am not afraid of unplugging when needed so I can spend quality time with my family. We have family dinners regularly and I love traveling. We take family trips and spend quality time together.

Guilty pleasure: Traveling the world and eating sweets. I love watching and playing tennis.

Favorite book: I do not have a favorite book. I prefer reading magazines and newspapers; it keeps me current.

Favorite movie: “The Godfather.”

What do most people not know about you? My wife is the secret behind my success. Without her, I would not have been able to accomplish what I can today. She is my number-one supporter and has always encouraged me to follow my dreams and pursue my passions. Since the beginning of my journey, when I did not have any money, she’s been by my side. I do everything with her.

Pet peeve: I hate clutter.

What did you want to be when you grew up? An entrepreneur.

Last vacation: Portugal. Person I’d most like to have lunch with: I love having lunch with my wife.

Business philosophy: Work hard, treat people right, be honest, and take calculated risks.

Management method or style: Hands-on.

Greatest challenge: Keeping and growing a successful business year after year.

How do others describe you? Quiet, smart, straight shooter.

One thing I’m looking to do better: I always want to do better, and I always learn from mistakes.

How I give my team room to innovate and experiment: I let them be themselves, I let them do what they do best. I’m very supportive of their ideas, and I implement them if they make sense. I guide them by asking the right questions.

How close are you to operations? Very close. I am aware of day-to-day events. Super close!

What are the two most important things you rely on from your franchisor? Leadership and innovation.

What I need from vendors: Honest people who work effectively and efficiently. Have you changed your marketing strategy in response to the economy? How? Yes, we adapt our strategy based on the environment, and we support and rely on overall brand directions. I believe timely strategy change is key to the success of the business.

How is social media affecting your business? Social media has become an integral part of all businesses, especially to keep generations engaged in a brand. Everyone has adopted the new ways, and as we continue to grow and adapt I will continue to learn and grow my business.

How do you hire and fire? Hire extremely carefully, and look for quality and attitude. We cross all our t’s and dot all our i’s before we terminate someone. We believe in people and are always trying to work with them.

How do you train and retain? For the most part we tend to follow our brands’ training systems, recommendations, and timelines.

How do you deal with problem employees? We engage head-on but keep it consistent. I have dedicated staff to address every employee concern, particularly problem employees.

What's the fastest way into your doghouse? Dishonesty.

How did Covid-19 affect your business? The short answer is that it taught us to adapt literally daily. Because 98% of our businesses had a drive-thru when dining rooms were closed, we were able to continue operating. The majority of our brands really flourished. We also found an opportunity to give back and become a pillar to our community.

How have you responded? In the long run, it made us stronger. We implemented many systems during Covid that are still in place today.

What changes do you think will be permanent? None. I think as a society we will continue to learn, and we will adapt.

Annual revenue: $300-plus million.

2023 goals: Keep expanding, keep the existing business profitable under the current cost pressures, and work with our brands’ management to improve standards.

Growth meter: How do you measure your growth? Number of locations, number of brands, and new development.

Vision meter: Where do you want to be in 5 years? 10 years? To me this is already retirement. I enjoyed doing what I do, so I just see myself continuing to grow in the next 5 to 10 years.

Take care of your employees, they take care of the customer who will return, and profits will improve to continue to take care of our employees. I believe that providing a great environment and treating employees like family is one of the best things we can do for them.

Do you have brands in different segments? Why/why not? Yes, QSR, fast casual, and sit-down. The diversification really helps when one brand or segment is not doing that well.

How is the economy in your regions affecting you, your employees, your customers? Should I just say most of our locations are in California. I love the state, but it is probably the most-regulated state in the country and we are facing the same economic challenges as the rest of the U.S., particularly with inflation and even more with wages.

Are you experiencing economic growth in your market? Yes, the California market is constantly growing and we are growing along with it. We have plans to develop Noodles & Company throughout the state by adding 40 locations. And we are growing our Jack in the Box by developing 6 more locations in Central California and 18 in Southern California. We are working on adding two more locations in our Black Bear Diner portfolio. We’re constantly looking for good real estate sites and opportunities to grow and expand. Even now, as we have upcoming unit openings/locations in the

pipeline, we’re looking to expand into the hospitality industry through a partnership with Hilton.

How do changes in the economy affect the way you do business? We had to increase prices more than we liked, but we have worked hard to keep them below our competitors’ prices.

How do you forecast for your business? We are constantly observing trends and recommendations from the brand along with market performance.

What are the best sources for capital expansion? We prefer to keep our debt low and expand using our cash flow. It helps to build strong relationships as we have with big traditional banks.

Experience with private equity, local banks, national banks, other institutions? Why/why not? Mostly national banks since we have long-term established relationships.

What are you doing to take care of your employees? We keep improving our benefits, and for many years we have operated under the Service Profit Chain model: take care of your employees, they take care

of the customer who will return, and profits will improve to continue to take care of our employees. I believe that providing a great environment and treating employees like family is one of the best things we can do for them.

How are you handling rising employee costs (payroll, minimum wage, healthcare, etc.)? It’s a delicate balance, and we’re constantly looking for ways to improve efficiency and balance the rising rates.

What laws and regulations are affecting your business and how are you dealing with them? PAGA claims and the new FAST Recovery Act are just two of the big ones. We have put many systems in place to make sure we are in full compliance and work with our brands and legislation to put laws in place that protect our employees.

How do you reward/recognize top-performing employees? We always keep our employees and their well-being top of mind. We diligently find ways to improve benefits and provide certificates, bonus, recognition, etc. to boost employee satisfaction.

What kind of exit strategy do you have in place? None. I want to continue to grow and pass it to my family.

After 50 years in business, Robert Rodriguez has come to some conclusions about what work can be— and is using them to drive toward $1 billion in annual revenue for the Tasty Restaurant Group (TRG). After just 5 years, TRG is at 421 units with 6 brands in 22 states. For Rodriguez, though, building TRG is about more than money.

“We want to create an organization where people want to come to work for us,” he says. “I want to treat people the way I wish I had been treated. I tell everybody that this may not be the job they have in 20 years, but when they leave they will be a better professional than when they came.”

Rodriguez’s philosophy emerged after decades of work, many of them in the corporate setting he stepped away from so he could act on his vision. “I believe strongly that there has to be a balance between career and personal life,” he says, a goal that aligns with his long-held desire to help others. He grew up wanting to be a teacher. “Coaching and helping others hone their skill set gives me great satisfaction.”

Trust, transparency, and honesty are the cultural values of TRG, he says, tenets that go along with scholarship programs for employees, acknowledging top performers in a variety of ways, and filling 80% of TRG positions with talent from within. Covid had an impact on TRG, as it has for all businesses, he says, and the company has responded by being more collaborative, strategic, and innovative.

First job: McDonald’s crew member while attending high school at age 15 in Miami, Florida.

Formative influences/events: My parents emigrated from Cuba to the U.S., fleeing conditions there. Seeing our family members struggle in a new country, not knowing the language, and scraping by gave me enormous inspiration to make the most of what I have and to prove to myself that I could accomplish what I set my sights on.

Key accomplishments: Finishing my education through to my MBA. Nothing came easy, but just having the opportunity and freedom gave me the inspiration to keep working. Believing in oneself makes most things possible.

Biggest current challenge: To continue to build a family culture within our organization. The restaurant business is about millions of details and working to get them right to serve our guests. Caring for our employees, who in turn care for our guests, who in response care for our business completes the circle.

Next big goal: To get our company to $1 billion in sales within the next 5 years.

“Surround yourself with the brightest and most capable team members. Lead the team by energizing them.”

First turning point in your career: There are two. First would be joining PepsiCo and spending 12 years learning the business, from the details of the corporate world to becoming an executive. Second would be completing my MBA at Kellogg.

Best business decision: Working for multinational brands that are tactical and strategic at the same time.

Hardest lesson learned: There is no tomorrow, you have to show up every day and give it 100%.

Work week: Whatever it takes to get it done professionally at the highest level possible.

Exercise/workout: Playing golf and walking the course.

Best advice you ever got: In junior high school from a teacher: Whatever you tackle in life, whether science or collecting trash, be the best you can be.

What’s your passion in business? I feel a deep responsibility to coach and guide others in this business to be successful—and seeing their enjoyment when they achieve the highest pinnacle of performance.

How do you balance life and work? I so enjoy this business. It has taught me so much about life, and I have met countless inspiring individuals over the years. When you do what you love, there is not much balancing to do.

Guilty pleasure: Practicing my golf swing. Golf came later to me in life, so I have much to learn. But as the consummate (want-tobe) athlete I enjoy the challenge of pursuing the ideal swing. Studying how world-class golfers practice their trade is an enjoyable pastime for me.

Favorite books: Good to Great, Rethinking America.

Favorite movie: I am a movie buff, so I have many movies. If I had to pick one, it would “The Sting.” I never saw the ending coming.

What do most people not know about you? I love to salsa (dance, not eat) and love to do anything to please and enjoy my family.

Pet peeve: Being a victim in a problem. I don’t mind talking about problems, but there has to be a solution that we put all our energies toward. When there were hiring issues there were those who threw up their hands in frustration and closed their restaurants, and then there were those who rallied

together, leveraged their work families, and kept their businesses open. It is how you look at life, glass half-empty or half-full. I insist that it’s full.

What did you want to be when you grew up? A teacher. In many ways I still am. Coaching and helping others hone their skill set gives me great satisfaction.

Last vacation: Road trip with my family to Lake Tahoe.

Person I’d most like to have lunch with: My wife. I don’t spend enough time appreciating all she does for me and our family.

Business philosophy: Positive mindset, because most issues have a solution. Surround yourself with the brightest and most capable team members. Lead the team by energizing them and providing solid guidance.

Management method or style: Collaborative, decisive, focus with the end in mind.

Greatest challenge: Raising a successful family so they find their own way and achieve happiness. And going through Covid while maintaining a team focus and managing the financials of the company.

How do others describe you? Generous with time, attention, and insights. Caring, empathetic, and not afraid to show emotions. Quickly getting to the root issue and offering great counsel. Great storyteller.

One thing I’m looking to do better: You must always challenge your leadership style to make it more effective for everyone.

How I give my team room to innovate and experiment: I am not one to micromanage. I am hands-off on managing the individual businesses. That leadership comes from our brand officers, who each fully manage their P&L, operations, pricing, marketing, and budgets.

How close are you to operations? I travel 45 weeks out of the year, mostly to visit our teams in our restaurants. Conversations with our brand leaders occur a couple of times a week. As a company we are very hands-on and have a support staff in Dallas who work for our restaurants in the field. And we all work for our family team members who serve our guests in restaurants.

What are the two most important things you rely on from your franchisor? Brand strategy and innovation.

What I need from vendors: Partnership to help us all improve quality, gain efficiencies, and wow our guests.

Have you changed your marketing strategy in response to the economy? How? Our business is constantly evolving, so to stay relevant we need to adjust our strategy. Local store marketing has taken on greater importance. How we connect with our communities, employees, and guests requires us to use different channels. Guest reviews, third-party delivery channels, catering offerings, and local marketing all play a role in our business.

How is social media affecting your business? We have invested in social media to help us grow our business, connect with our guests, and help us partner with our family team members.

How do you hire and fire? We strive to hire in the image of our culture and family values. We don’t fire; people self-select when they cannot fit our cultural values or are not willing to be coachable.

Our business is constantly evolving, so to stay relevant we need to adjust our strategy. Local store marketing has taken on greater importance. How we connect with our communities, employees, and guests requires us to use different channels. Guest reviews, thirdparty delivery channels, catering offerings, and local marketing all play a role in our business.

How do you train and retain? Training is a continual process that never ends when you are working for Tasty. It is about growing people and maximizing their skills to a new level. It is our policy that 80% of our positions are filled with talent from within the organization. As for retaining people, when our culture is properly implemented and we have a continuing training process, individuals feel wanted, appreciated, and successful in their jobs (provided that the individual had a fit within the Tasty culture from the outset).

How do you deal with problem employees? We believe that there are no problem employees. It almost always is about fit and providing the tools for them to be successful.

Fastest way into my doghouse: Violate one of our cultural values of trust, transparency, and honesty.

How did Covid-19 affect your business? In a multitude of ways, from the way we need to manage people to the financial impact every decision we make has on the P&L.

How have you responded? By being more collaborative, more strategic, and thinking outside the box for solutions.

What changes do you think will be permanent? Employees’ expectations will be permanent, and so are the ongoing costs. Guests will continue to demand new channels of access to our products and restaurants. Companies that are first to innovate and prevail in different channels of distribution will be the long-term winners.

Annual revenue: $400 million for Tasty Restaurant Group; $20 million for Dunkin’ and Baskin-Robbins.

2023 goals: Improve guest satisfaction, achieve all our remodels and new developments on a timely basis, and improve employee satisfaction.

Growth meter: How do you measure your growth? Everything we do is measured through a metrics system that we agree on as a team to achieve. Therefore, we have metrics on every single goal or objective we set annually.

Vision meter: Where do you want to be in 5 years? 10 years? We have a strategic plan with a clear vision and mission

including a 5-year financial plan. This plan is reviewed quarterly with our internal board of directors.

Do you have brands in different segments? Why/why not? We strategically chose to be in the beverages and snacks, burgers, pizza, chicken, and Mexican categories. We continue to look for opportunities to broaden our holdings into the sandwich category.

How is the economy in your regions affecting you, your employees, your customers? We operate in 22 states. Although there are different nuances by state and city and the political landscape continues to shift on a macro basis, these factors make every day a little more challenging to operate profitable businesses.

Are you experiencing economic growth in your market? At Dunkin’ and Baskin we have had growth, however not to the levels we expect from our operating team. We have adjusted our leadership of the brand to address the potential we see. We contrast our brands against one another and see great opportunity for improvement in the performance of our Dunkin’ business.

How do changes in the economy affect the way you do business? Over the past several years the financial impact from the economic challenges have affected every line item of our profit-and-loss statement, bar none.

How do you forecast for your business? We remain bullish on the QSR concepts, but also understand that today we must conduct business differently from how we did yesterday to endure the financial pressures the industry is under.

What are the best sources for capital expansion? Operating profits from existing operations. No bank will approach you if you are unable to consistently replicate the financial model.

Experience with private equity, local banks, national banks, other institutions? Why/why not? We are a private equity–funded company.

What are you doing to take care of your employees? We are taking advantage of scholarship programs for employees, all district managers are involved in once-a-week recognition and posting of our employees on social media, continual development of skill sets through in-house training, Center

for Creative Leadership attendance, and surveying employees to understand their needs and wants.

How are you handling rising employee costs (payroll, minimum wage, healthcare, etc.)? We must meet the minimum requirements the market expects. The culture within each restaurant and how you take care of people are perfect for these types of circumstances.

What laws and regulations are affecting your business and how are you dealing with them? They have enormous impact on the financial model of our businesses. My biggest concern at the moment is the new legislation passed in California that is an attempt to unionize the quick-service industry.

How do you reward/recognize top-performing employees? We acknowledge top performers in a variety of ways. Some examples: annual performance reviews, progression ladder of growth, investment in development (we send potential leaders to the Center for Creative Leadership), bonus programs, attendance at national conventions, publishing weekly rank and stack performance metrics, posting positive guest comments and calling out great service, team rally and dinners, top performers sharing their secrets to success with others, and we publish an in-house newsletter acknowledging top performance.

What kind of exit strategy do you have in place? At this time, my partners and I are exclusively focused on getting Tasty to our goal of $1 billion in annual revenues.

We’re taking over. There’s so much fresh territory to set up fresh franchises with the freshest sandwiches in the game. We’re ready to roll, are you?

Everything about Jimmy John's - the menu, the marketing, franchise management - is simple. No games. No gimmicks.

We promise an honestly good sandwich and deliver on that promise. That's why customers have come to trust us.

When you start a business in a garage and nurture it into a nation-wide franchise, that's ass-kickin' execution.

Helen Martin spent enough time working in corporate settings doing marketing, sales, and operations to come to a definite conclusion—especially in one job, where one of her tasks was to hand out severance packages. “From that point on, I wanted to control my own destiny,” she says, and franchising was “a great stepping-stone to go out on one’s own.”

Martin, a former athlete, discovered Stretch Zone in 2014. The brand fits well with her awareness of the quality of life resulting from improved physical health. When she became involved, first as a licensee, then as a franchisee, Stretch Zone was not well known. But helping people was an idea that appealed to her. She also liked the idea of

franchising a business model that “gives you a blueprint but doesn’t tell you how to decorate—it allows you to be creative,” she says.

Today, Martin is fully engaged in Stretch Zone. She has 19 locations, is buying 4 more, and helps other franchisees manage an additional 15. She also heads the brand’s Franchise Advisory Council and is a member of its corporate board.

“I have so much Stretch Zone in my blood it would be hard to do another concept,” she says. She also is determined to help others succeed with the brand, as others did for her. “Nothing makes me happier than to help someone open and learn they are number-one in sales the next month.”

First job: Worked at a local sporting goods store when I was 15.

Formative influences/events: I had some amazing mentors and bosses in my previous corporate life who shaped my professional self! My biggest takeaway: Always know your numbers.

Key accomplishments: Created a management company during Covid to keep my regionals working, and helping other absentee franchisees.

Biggest current challenge: Hiring. Next big goal: Looking at 40 to 50 locations in 3 years.

First turning point in your career: Became the youngest buyer at Sports Authority, a company that Dick’s Sporting Goods bought several years ago.

Best business decision: Taking a chance with Stretch Zone very early on—even before we had a website. I had demo cards and a Rolodex!

Hardest lesson learned: Never doubt your gut.

Exercise/workout: Seven days a week: 2 days with a personal trainer, 4 days of running, and 1 day of Peloton. What’s your passion in business? Developing and growing a team!

“I am changing my pay model to a higher salary and less commission-based.”

How do you balance life and work? I’m a yes person, so I need to do better at creating more of a work/life balance. Currently, I’m putting more infrastructure in place to help with this because I don’t say no very often!

Guilty pleasure: Gummy Bears.

Favorite book: Reminiscences of a Stock Operator by Edwin Lefèvre.

Favorite movie: “Fried Green Tomatoes.”

What did you want to be when you grew up? Attorney.

Person I’d most like to have lunch with: Any of the titans of industry—J.P. Morgan, Rockefeller, Carnegie, or Walt Disney. The ability to create an industry is remarkable, and I would love to pick their brains.

Business philosophy: When there is an opportunity knocking, you have to answer!

Management method or style: Set the strategy and let my team implement. Trust, but verify!

Greatest challenge: Understanding Millennial workforce priorities.

How do others describe you? Driven, quick-witted, persuasive, loyal, and fair.

One thing I’m looking to do better: Work/life balance.

How I give my team room to innovate and experiment: We have very open dialogue about opportunities and current situations. I always try to pose things as a question to solicit their feedback.

How close are you to operations? Heavily involved day-to-day.

What are the two most important things you rely on from your franchisor? Innovation and brand name growth. What I need from vendors: Communication and timelines.

Have you changed your marketing strategy in response to the economy?

How? No, our first stretch has always been free, and we will continue that. However, during Covid self-care became very prevalent, so we have woven that into our messaging a bit more.

How is social media affecting your business? It is the largest producer of leads for us.

How do you hire and fire? I have invested in quite a few software options for hiring. When it comes to firing, I am of the threestrikes rule mindset. We warn, coach, counsel, and terminate on the third strike.

How do you train and retain? Create a great culture and a growth path for upward mobility.

How do you deal with problem employees? I always try to speak with them and find out where the breakdown is. I ask a lot of questions to find out if it can be fixed or how they want to fix it.

Fastest way into my doghouse: Not reading emails and not following directions!

COVID-19

How did Covid-19 affect your business? Rocked my world as it did for many. Some of my locations were closed for 4 weeks, some were closed from 6 to 8 weeks, depending on the municipality.

How have you responded? I definitely review leases differently and read the fine print about national disasters. I was very lucky— most of my landlords were great.

Annual revenue: $6 million to $7 million (est’d).

2023 goals: Increase profitability.

Growth meter: How do you measure your growth? Comp growth year over year for each location. I am always looking for double-digit growth.

Vision meter: Where do you want to be in 5 years? 10 years? My goal is 40 to 50 studios within the next 3 years.

Do you have brands in different segments? Why/why not? Not at this time.

I am so homed in with Stretch Zone as an ambassador of the brand that I haven’t really thought about others.

How is the economy in your region(s) affecting you, your employees, your customers? Employees need to make more. Rents and wages are not keeping up with the price increases on my side.

Are you experiencing economic growth in your market? I have studios located mostly in Florida, with some in Texas and North Carolina. Those states are growing because they are very pro-business.

How do changes in the economy affect the way you do business? It makes me more conservative with cash.

How do you forecast for your business? Historical sales, marketing activities, and staffing are all part of the equation each month.

What are the best sources for capital expansion? I have been self-funded for a significant time, but recently started with Apple Pay to help me acquire more stores.

Experience with private equity, local banks, national banks, other institutions? Why/why not? Our model is not asset-intensive, so traditional banks are difficult. Traditional lending institutions want freezers, machines, pizza ovens, etc.

What are you doing to take care of your employees? Try to do fun team-building activities, recognition, and cover 75% of their health care.

How are you handling rising employee costs (payroll, minimum wage, healthcare, etc.)? I am changing my pay model to a higher salary and less commission-based. If I don’t make this change, I will not be able to attract top talent. Maintaining the quality of our service is crucial.

What laws and regulations are affecting your business, and how are you dealing with them? None at the moment.

How do you reward/recognize top-performing employees? Appreciation, brand swag, and money.

What kind of exit strategy do you have in place? I have built my management company to run each of my studios, so my goal is to sell all my studios with the management company in place. This turns it into a turnkey operation for an equity group later on. Also, my vision is to allow my regional team to take over the management company once I am no longer in a day-to-day role.

Dale Mulvey was nearing 50 when he signed on for his first McAlister’s Deli franchise location. The decades of business experience he brought to his new endeavor may explain why he was named the brand’s Franchisee of the Year just a year after opening that inaugural unit. Fourteen years later, Mulvey operates 74 McAlister’s and 8 Moe’s Southwest Grills.

That portfolio was nowhere in his dreams when he headed off to college in Indiana. But Mulvey quickly realized that his natural abilities and the mentorship of his first employers at the mom-and-pop bar/restaurant where he found part-time work were a much

better career fit than the future as a lawyer he had planned. Working in a different sort of service industry just “clicked for me,” he says. “I instinctively knew some things about costs, prices, and marketing.”

His next business education came as a management trainee for a large local chain of pizza operators whose owners were innovators—the first to offer personal-size pizzas at lunch and to offer those appetite-enhancing breadsticks ready on every table for patrons to enjoy as soon as they sat down. Mulvey progressed quickly, learning the basics and developing skills as a troubleshooter and then as a field marketer. He returned to the chain’s main office for a time to gain from the franchisor point of view. All of that experience, he said, “gave me a strong base to think about things.”

Covid tested Mulvey, as it did everyone. But he credits his father, grandfathers, and his very first job shoveling snow from neighbors’ driveways and sidewalks for building the unflagging work ethic, professionalism, and entrepreneurial spirit still evident in all he does.

First job: My first job was actually working for myself as a young boy. I’d do a variety of handyman jobs like shoveling snow, raking leaves, gardening, etc., for family friends. That entrepreneurial spirit and drive was instilled in me at a young age.

Formative influences/events: I was fortunate enough to have role models in the form of my father and grandfathers. Each excelled in their career—from businessman to sheriff to professor. They would take me into work with them and I got to experience and understand the power and value of having a strong work ethic and how they balanced work and home life.

Key accomplishments: Being named franchisee of the year by McAlister’s Deli in my first year of business was a major accomplishment, but what stands out to me even more was how my team managed through the Covid-19 pandemic. Their work was

“I aim to work closely with people until they become better at things than I am.”

nothing short of remarkable. They stepped up, supported each other, the community, and the future of the business. This has been, by far, my proudest moment.

Biggest current challenge: We’re in the midst of experiencing a changing work environment. The biggest challenge is understanding how to meet the expectations of a new workforce while supporting the existing, seasoned team members who are the core of the business. It’s a delicate balance that certainly comes with trial and error.

Next big goal: We have a variety of growth goals with McAlister’s Deli and Moe’s Southwest Grill, but my next big goal is focused on our people. We know our team is our greatest asset, so amid today’s labor challenges we want to make sure they are supported as we build our future.

First turning point in your career: My experience in working my way up to an ownership opportunity and all the lessons learned from that journey. I worked at a bar/ restaurant at Indiana University checking IDs and was recruited to another business.

From there, I worked my way up to a management position and eventually bought the business. I learned a lot from this experience, gained a lot of mentors, and solidified for me that entrepreneurship was where I wanted to take my career.

Best business decision: Entering into McAlister’s Deli in 2008. I was looking for an entrepreneurial opportunity where I could grow my business portfolio. McAlister’s presented a great opportunity with the potential to scale quickly.

Work week: This is the beauty of entrepreneurship—the work week is anything but typical. I do try to travel to the markets every other week to meet with our team, boots on the ground. In the off-travel weeks, I’m focused on back-office work. Above all, I try to be flexible and allow for family time.

Best advice you ever got: Be as honest and straightforward as you can. Hard work matters, and persistence means more than anything else.

How do you balance life and work? As an established entrepreneur, I truly get to spend a lot of time with my family, especially my young grandchildren. I aim to be opportunistic with the time I do have with my family and manage my work around them.

Guilty pleasure: While it might not sound adventurous, my guilty pleasure is spending quality time with my family, whether at home, dinners, traveling, hiking, etc. As long as my family is around, I’m enjoying myself.

Favorite books: The Little Prince, Jonathan Livingston Seagull, Oh, The Places You’ll Go!

What did you want to be when you grew up? A lawyer, but I quickly realized that college didn’t interest me as much as working right away and establishing a business career.

Management method or style: I aim to work closely with people until they become better at things than I am. I then try to give them the autonomy to make decisions. Sure, I’m still there to monitor, challenge, and support them, but I’m empowering them and trusting them to act.

How do others describe you? Hard worker, fair-minded, good listener, and doesn’t hesitate to make decisions when it’s decision-making time.

One thing I’m looking to do better: Be more mindful. It is so easy to get “too busy” and let things pass you by. I’m trying to be more intentional about being in the moment and taking more time to take care of myself.

What are the two most important things you rely on from your franchisor? Maintaining a strong brand identity and growing brand awareness. What I need from vendors: Consistency, reliability, and transparency.

Have you changed your marketing strategy in response to the economy? How? No. If anything we’ve marketed more aggressively. We operated under the assumption that at some point, there will be some return to normalcy—and we wanted to remain top of mind. If anything, it is harder to determine where to spend dollars as there are more options and clutter than ever before.

How do you hire and fire? How do you train and retain? We’ve been very lucky to have an executive team that’s been with us for more than 20 years. Once you understand that your team is your greatest asset, invest in them, grow them into leadership positions. Having these people on your team helps breed other employees who are just as driven and loyal. Culture breeds culture.

How did Covid-19 affect your business? The beginning of 2020 was challenging, one of the most difficult times in my career. In March 2020, we had to furlough 1,700 people. We had 300-plus people salaried and full-time hourly, and we kept them and did not cut salaries. That core group stepped up, and I can’t say enough about how much they did and how they adapted to support the company. We still have most of those 300 people today. Since March 2020, we have seen great growth in our business and have since experienced some of the best AUVs we have ever had.

How have you responded? Initially our response was just to communicate effectively. We had weekly calls with all our team members, where every question and comment was on the table. We had to be able to do more with less and rely on each other more than ever before. We also committed to meet our customers wherever and however they chose, whether dine-in, carryout, app-based, catering, or third-party delivery.

My experience in working my way up to an ownership opportunity and all the lessons learned from that journey. From there, I worked my way up to a management position and eventually bought the business. I learned a lot from this experience, gained a lot of mentors, and solidified for me that entrepreneurship was where I wanted to take my career.

Gross Sales of the top performing 25% (or 70 units) of Hungry Howie’s Franchised Units that were open for the entire 52-week period from December 28, 2020 through December 26, 2021. “Franchised Units” means all Hungry Howie’s Units that were open and reporting sales to us for the entire fiscal year, and excludes units in the State of Florida, affiliated units, units which opened or closed during the entire fiscal year, legacy units which are not obligated to and do not report sales to us, and units that were closed for more than ten consecutive days during the entire fiscal year due to a force majeure event (e.g. COVID-19). The Franchised Units are in 20 states. These Franchised Units have reasonably similar operations as those being offered for sale. See Item 19 of Hungry Howie’s 2022 Franchise Disclosure Document for additional information. This information is not intended as an offer to sell, or the solicitation of an offer to buy, a franchise. It is for informational purposes only. Currently, the following states regulate the offer and sale of franchises: California, Hawaii, Illinois, Indiana, Maryland, Michigan, Minnesota, New York, North Dakota, Oregon, Rhode Island, South Dakota, Virginia, Washington, and Wisconsin.If you are a resident of one of these states, we will not offer you a franchise unless and until we have complied with applicable pre-sale registration and disclosure requirements in your jurisdiction.

What changes do you think will be permanent? Doing more with less and meeting the customer how and where they choose as their choices expand. This will require us to be nimble and always have an eye on the future.

Annual revenue: $120 million. 2023 goal: $135 million.

Growth meter: How do you measure your growth? Average unit volume.

Vision meter: Where do you want to be in 5 years? 10 years? We will steadily grow our McAlister’s Deli business while also expanding Moe’s Southwest Grill. We will become more real estate-oriented and look for additional opportunities as the market presents them.

Do you have brands in different segments? Why/why not? Yes. We have great diversity of talents on our team, and diversity of brands allows us to maximize those talents.

How is the economy in your regions affecting you, your employees, your customers? Sales continue to be strong. However, team-building and maintenance continue to be challenging. Are you experiencing economic growth in your market? Yes.

How do changes in the economy affect the way you do business? Changes in the economy primarily affect the way we do business as it relates to acquisitions and new store growth.

How do you forecast for your business? We forecast annually, based on the previous year and current trends.

What are the best sources for capital expansion? Having trusted partners. Experience with private equity, local banks, national banks, other institutions? Why/why not? Yes. We have had good luck with private equity and regional banks.

What are you doing to take care of your employees? We try to listen closely, pay fairly, communicate fully, and add some fun where we can.

How do you reward/recognize top-performing employees? We reward outstanding employees in different ways including bonuses, awards, and trips.

What kind of exit strategy do you have in place? I have two sons in this business and a strong, young executive team. We are still very future-based.

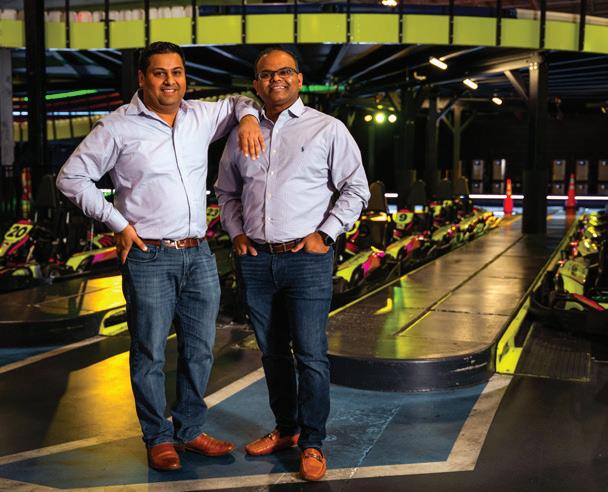

Kal Gullapalli spent 7 years on Wall Street before the entrepreneurship bug bit him in 2016. Now he’s on a fast track in franchising, running 42 Marco’s Pizza stores and aiming for 100. He also operates 46 European Wax Centers and 2 VIO Med Spas.

“I’m spending a lot of time learning from others,” he says. “What are the 15- to 20unit folks doing now? What are the 100unit folks doing?” As he hit each milestone, Gullapalli has learned that each comes with its own challenges. “You can get away with a lot at five... and nothing at 100,” he says.

Whether attending conferences, becoming involved in franchise councils, or simply asking people in franchising to share their best practices, Gullapalli is constantly working to learn more about building a success-

ful franchise organization—and has learned more than a few lessons on the way.

Expanding rapidly, for instance, taught him that “sometimes you think you can scale more quickly than you should.” And when problems inevitably arise, he’s an advocate of a quick response. “Once we agree something is a mistake, we look for solutions right away,” he says.

As he builds toward his goal of 100 Marco’s locations, Gullapalli has realized he’ll have to build a flexible training team and larger support infrastructure to open new locations and to coach employees in existing stores. Creating that team will be a definite requirement for reaching his goal.

None of this deters him on his growth path, however. “I’ve always wanted to be part of growing a very large organization,” he says. “I like the challenge.”

First job: Insider at Little Caesars.

Formative influences/events: Playing sports from an early age gave me the ability to work in a team environment. My parents instilled in me that having a strong work ethic is vital to success in our professional lives. My first job at Little Caesars gave me the confidence that if I could lead a team at the age of 17, I could probably further hone my skills and lead larger teams.

Key accomplishments: I’ve sold 5 different companies in 6 years. Two kids!

Biggest current challenge: Labor. Finding qualified team members is challenging in an environment where unemployment is at 3.7%. However, Marco’s “Passion for Primo” initiative helps us recruit and retain talent in creative ways. We’ll continue to lean into this as labor remains an ongoing challenge in the restaurant/QSR industry.

Next big goal: To have 100 profitable Marco’s Pizza restaurants.

Best business decision: Getting into franchising. I realized in my early 30s that I like getting a playbook and following it. In franchising, it’s easier to scale quickly.

“Diversifying my franchise portfolio with Marco’s Pizza has really helped my business thrive.”

Work week: I’m very passionate about what I do, so for me, it’s not really viewed as work. Because of that, I put a lot of hours in. I’m not sure there is a day that I don’t do something. So I do work 7 days a week, but I’m starting to get a little more balance in my life.

Exercise/workout: I work out anywhere from 2 to 5 days a week. It helps me get in the right mindset. There are times when I have not placed enough emphasis here, but I’m working hard to do so.

Best advice you ever got: From my immigrant parents: “This is the best country in the world. If you work hard, you can achieve whatever you want.”

How do you balance life and work? I have not been great at this in the past. I put way more emphasis on work in my 20s and 30s. But in my 40s, and with my wife’s guidance, I’m becoming more balanced. It’s still a work in process.

Guilty pleasure: I enjoy eating great foods, so my family goes out to restaurants whenever we have the chance.

What did you want to be when you grew up? Professional basketball player. Until about 7th grade, this was my dream. But in 8th grade, I realized I was not as passionate about the sport as some of my peers.

Last vacation: Costa Rica with my family for my 40th birthday.

MANAGEMENT

Business philosophy: Treat your team

well, pay them a fair wage, and provide clear expectations.

How do others describe you? Quiet, but a great motivator.

One thing I’m looking to do better: Getting every location to look, feel, and operate the exact same way.

How close are you to operations? Given our size, I do not get to sites as often as I would like. But I am on weekly ops call with our senior team, a monthly virtual call with our managers, and have quarterly in-person meetings with our managers.

What are the two most important things you rely on from your franchisor? To make decisions that help franchisees be more profitable, and to provide ops support when needed.

What I need from vendors: To be timely and communicative.

How do you hire and fire? I tend to hire slow and fire fast. If I’m hiring or firing, I’m looking to see if the team member has heart and a desire to work hard. If they have both of those traits, I know they will align with our core values.

How do you deal with problem employees? We are very transparent and communicative in addressing the problem and providing the resources needed to resolve and find a solution. We give them one or two chances to address it, and if they don’t adjust to tweak their methods they will be gone.

Fastest way into my doghouse: To not show up, or to give up before you try.

How did Covid-19 affect your business? As an owner of several fitness locations and health and wellness retail centers, I saw the nonfood service industry completely shut down. This jarring realization triggered me to begin looking at the franchise brands that were thriving. This led me to Marco’s Pizza, which was experiencing double-digit, record-breaking sales growth.

How have you responded? Diversifying my franchise portfolio with Marco’s Pizza has really helped my business thrive.

What changes do you think will be permanent? Consumers will continue to expect restaurants to accommodate their demand for both delivery and carryout options. I expect the convenience of curbside carryout and pickup windows to continue

because many people don’t want to leave the comfort of their own vehicle.

Annual revenue: $35 million in 2022. 2023 goals: $45 million.

Growth meter: How do you measure your growth? Our main focus is EBITDA, or profitability. Without positive EBITDA, we can’t grow.

Vision meter: Where do you want to be in 5 years? I would like to have 100 profitable Marco’s and then talk about getting to 200!

Do you have brands in different segments? Why/why not? Yes. During Covid, I learned that diversification was really important. Some sectors were really affected during the shutdowns and others were not. Pizza, for example, was a beneficiary.

How do changes in the economy affect the way you do business? Changes in the economy significantly affect our business. We are directly tied to the consumer, so if consumers have higher discretionary incomes, we do better.

How do you forecast for your business? We do a full budget by store and then forecast out the next 3 years. Included in that will be our assumptions for sales growth, new store development, and acquisitions.

What are the best sources for capital expansion? Capital expansion can come through equity and debt. Luckily, we have been able to secure both through various investors, but also by working with banks that are supportive of long-term growth.

What are you doing to take care of your employees? I offer competitive pay and work to empower and motivate my team. I’m a big believer in letting your team know how much you appreciate their work and showing them their impact. This, in turn, will result in increased motivation and energy.

How are you handling rising employee costs (payroll, minimum wage, healthcare, etc.)? Like many businesses, we see a trend of increased costs in the economy, including employee wages. I currently offer competitive pay to make sure we are hiring top talent who are driven to grow in their roles. To manage these increased expenses, our team works tirelessly to find ways to increase profits and maintain a smaller group of employees.

I offer competitive pay and work to empower and motivate my team. I’m a big believer in letting your team know how much you appreciate their work and showing them their impact. This, in turn, will result in increased motivation and energy.

After nearly 20 years of Scooter’s Coffee franchising and becoming the brand’s largest franchisee, Tracy Bouwens is not done growing. She has 59 locations up and operating and says she’d like to add at least 20 more by the end of 2026 and eventually hit the 100-unit mark.

“Growth is healthy,” says Bouwens. Her company, Freedom Enterprises, added 16 locations in 2022, an expansion she says resulted from lessons learned during Covid. “It was incredibly challenging, but out of it we learned to be even more adaptable. We were prepared to move when we needed.”

A few years ago, adding 16 units in a single year would have been “painful,” she says. Today, however, the challenges that come with growth no longer surprise her because, she says, “We are learning and growing and continuing to develop.”

When we last spoke with Bouwens in Q4 2020, she and her husband, Shawn, were partners in both business and life, but he is now retired from franchising.

“He is the greatest,” she says of the man who first retired after a career as an offensive lineman with the Detroit Lions. “He’s always been willing to do whatever I needed him to do.” She especially enjoys “having someone at home to make me dinner!”

Bouwens, a youthful grandmother of six, is working to develop people to take over some of her roles. “I’m always strategizing that way,” she says—in part because it gives her great joy to see her people develop. That’s in addition to her other source of happiness: seeing the positive impact her Scooter’s locations can have on the communities they serve.

First job: Washing dishes at 14 in a smalltown restaurant.

Formative influences/events: I grew up with an adventurous father who was also an entrepreneur. Watching and learning from him, I knew that no matter what profession I entered, I wanted to own my own business. As I researched the specialty coffee business before opening my first Scooter’s, I ran all of my research data by my dad. His opinion and assessment were invaluable to me as my husband and I were learning to navigate through what a successful business would look like.

Key accomplishments: Married for more than 30 years. Successfully raised three amazing children. Becoming the largest Scooter’s Coffee franchisee with 59 locations. Serving on the board of YouCanFreeUs, an international human rights organization fighting modern slavery around the world through advocacy, rescue, and rehabilitation.

“As leaders, we need to give credit where credit is due. ”

Biggest current challenge: As most in the restaurant or QSR industry would probably say, staffing. But our key focus is to change our mindset from what leadership looked like pre-Covid and find the way to lead our teams through this new era, not to just survive but to set up our leaders to thrive! Our primary job is to be problem solvers. Rather than focusing on issues, we focus on solutions to those issues. I can’t control everything, so our goal is to focus on what we can control and move forward in that way.

Next big goal: To open or acquire a minimum of 20 new locations by the end of 2026. Ultimately, I think it would be awesome to achieve the 100-location mile marker!

First turning point in your career: When we first became a Scooter’s Coffee franchisee, we owned a single location in Omaha. Our first turning point was in 2005, when we purchased the Kansas City market and became area representatives for the Scooter’s Coffee brand.

Best business decision: Becoming a franchisee was an excellent path for us to become business owners while having the structure, systems, and processes that come with being a part of a franchise system.

Hardest lesson learned: Cash flow! As we began to grow rapidly in the past 10 years, learning to accommodate existing store operations along with allowing for the cash reserves needed to add new stores was a huge lesson I needed to learn. I am so thankful to have been able to develop processes for managing cash within our company that allow us to continue advancing, while still being a financially responsible company.

Work week: Mostly Monday through Friday. I rise early (after all, we are in the coffee business), but I end my day by 5 or 6 p.m.

Exercise/workout: I love my Peloton bike. Recreationally we love to play pickleball and take long walks at our cabin on Table Rock Lake.

Best advice you ever got: It’s just coffee. So often it can be easy to get overly worked up about small issues as they arise. If we remember that, at the end of the day, we get to put a smile on people’s faces as we serve them their morning coffee the rest of the stuff will work itself out and we can tackle one issue at a time.

What’s your passion in business? My passion continues to be the people part of

our business. I am so blessed to have an amazing group of individuals who work for us. Whether they are with us for a short time or for more than a decade, I absolutely love seeing their skill sets develop as they grow with our company. Seeing how those developing skills affect them in their personal lives is an added bonus.

How do you balance life and work? Finding work/life balance was very hard for me in the early years. I have discovered that I am far better and accomplish more when I keep that balance in check in my life. The way I am able to do that is to be very organized with my time and efficient in how we get things done. I have a notebook by my side throughout each day to write down thoughts as I go. Then when my day ends, I don’t find my mind racing with loose thoughts flowing in every direction. The notebook will be there tomorrow.

Guilty pleasure: I truly love trying various wines, particularly a good Sauvignon blanc from France or New Zealand.

Favorite book: I really enjoy reading historical fiction books because they bring history alive in fun ways, and we have so much we can learn from history. I also enjoy reading leadership books so I can continue to grow in my leadership skills. My bookshelves are overflowing with both types of books. However, every day I take time to read from the Book of Proverbs in the Bible. I find it

very helpful to meditate on and absorb the wisdom found in that book.

Favorite movie: “The Notebook.” I am a sap for a good romantic movie.

What do most people not know about you? I have a single tattoo on the top of my right foot that serves as a daily reminder that I need to accomplish my goal of writing my first book.

Pet peeve: Poor communication skills or lack of communication.

What did you want to be when you grew up? A surgeon.

Last vacation: Turks and Caicos in October 2022. We try to be intentional about vacationing three or four times a year. The rest and relaxation allow me to slow down and really get back to creative business strategy.

Person I’d most like to have lunch with: Mother Teresa. She spent more than 50 years of her life comforting the poor, the dying, and the unwanted. Her servant heart and affinity for philanthropy are incredibly admirable. She left a positive impact on this world, and I believe that is something we should all strive to do during the short time we are here on Earth.

Business philosophy: Operating our business (each individual location) with excellence on every level while constantly assessing the ways that we, as leaders, can grow ourselves individually, which will in turn grow the organization as a whole.

Management method or style: Coaching and empowerment. By myself I can accomplish only a little. With each leader we get to coach and empower we are able to multiply our impact and accomplish far more than ever imagined.

Greatest challenge: For me, the greatest challenge is knowing the right timing to add new positions to our growing organization and still maintain a reasonable labor budget. I’m not afraid of working hard or carrying a heavy load, so sometimes I can wait too long before adding that next position. As we grow and I strive to maintain work/life balance, I find myself working ahead on those critical positions more strategically.

How do others describe you? A good friend recently described me as “the Christian version of Beth Dutton” from the “Yellowstone” series. (I hope that is a com-

For me, the greatest challenge is knowing the right timing to add new positions to our growing organization and still maintain a reasonable labor budget. I’m not afraid of working hard or carrying a heavy load, so sometimes I can wait too long before adding that next position.

pliment, ha-ha!) I think those who know me the best would say that I am kind and generous and I care deeply about people. At the same time, I don’t wait for others to solve my problems or grow my business. I own the responsibility and will move mountains to achieve my goals.

One thing I’m looking to do better: I have always admired the former CEO of Costco, Jim Sinegal. His philosophy was to always be a company that is on a first-namebasis with everyone. When he visited Costco locations around the country, he wanted to say hello and engage his employees because he truly liked them. As we continue to grow as a company and our employee counts increase, I want to continue to challenge myself to really know the managers in each of our stores and their teams as much as possible. There is so much value in having a company that truly cares about each of the individuals working for them.

How I give my team room to innovate and experiment: I try very hard to be quick to listen and slow to speak, allowing my team to share their ideas and to contemplate those ideas. As leaders, we need to give credit where credit is due. The best ideas will likely come from leaders on my team who are doing the heavy lifting day in and day out. I’m simply here to be a sounding board for those ideas.

How close are you to operations? I am very close to my top leaders in operations. Following John Maxwell’s leadership training, I spend 80% of my time with the top 20% of my leaders. While I am not involved any more in the daily operations of each individual location, I am very tuned in to our upper management team. Because I am so passionate about seeing individuals grow in their skill sets, I make it a weekly priority to spend time with them to listen, strategize, and coach them. I do not like to micromanage people. However, I thoroughly enjoy seeing them each have individual success in their roles. I want to be their biggest cheerleader, and when they make a mistake my job is to pick them up and help them move forward as they learn from those mistakes.

What are the most important things you rely on from your franchisor? Continuing innovation in product and technology. Implementing overall marketing strategies and trends that are up to date and relevant for our industry. Protecting the quality of the brand on a national level.

What I need from vendors: Dependability, consistency, communication, and competitive pricing.

Have you changed your marketing strategy in response to the economy?

How? With the rising cost of living, our customers are making choices on where to spend their money. Our focus is to continue to provide an amazing experience for each of our customers and to focus on customer appreciation events throughout our locations. In addition, I believe it is more important than ever to give back to the communities we are privileged to serve. There are times, such as these, when it is more important to focus our energies on how we can have a positive impact on those around us. The rest will take care of itself.

How is social media affecting your business? There are pros and cons to social media. It is a fantastic avenue for marketing and reaching our target markets, yet it also can be a sounding board for a less-thanstellar customer experience. I believe that if we use social media correctly it provides us with the opportunity to watch for ways we can improve our operations every day and effectively communicate with our customer base.

How do you hire and fire? We spend a lot of time and energy (and dollars) on recruiting and screening for team members for our growing company. We are looking for people with great personalities as well as stellar character and integrity. We can train for the rest of the skills we need. Our goal is to hire, train, and develop well so that we fire infrequently!

How do you train and retain? We have been working for years to develop and refine our training process, particularly for our leadership team. We are not perfect and will continue to refine those processes as we grow. We truly believe that if we equip and empower our team and create a positive culture and environment for people to work in, our retention rates will continue to exceed industry standards.

How do you deal with problem employees? Part of having a culture of training and developing our employees is providing effective avenues for constructive feedback. Our goal is to be consistent throughout all of our locations in providing that feedback and simultaneously providing a clear growth and career path for all interested employees. Fastest way into my doghouse: Lying, lack of integrity, trustworthiness. I just don’t have time for that, so I move on quickly when I see those characteristics come out of an individual or business.

COVID-19

How did Covid-19 affect your business? Covid-19 provided some of the greatest challenges of my business career, but I feel it also trained and equipped us, as leaders, to be prepared to move quickly in an ever-changing environment. It most certainly refined our problem-solving skills.

How have you responded? Initially, we had to adapt and change quickly, sometimes by the hour. I always want to be a company that can move quickly and adapt when circumstances require it. On this side of the pandemic, we are finding ourselves adjusting once again. We are in the business of coffee, but really it is the business of relationships with people. During Covid, we were not able to gather as often as we were used to doing. We now find ourselves having to be intentional about getting into the habit of face-to-face connections again. I believe we are wired to be in relationships with people, and I am absolutely loving reconnecting in person. It is such an important part of our company culture.

What changes do you think will be permanent? I think the staffing challenges that have arisen since the beginning of Covid are here for a while, at minimum. I do

believe that our world is evolving and changing at a faster pace than ever before in history, and therefore we must be willing and able to adapt as well. If we are going to survive as business leaders, we have to be willing to constantly self-reflect and adapt our leadership skills to that changing environment. If we are trying to lead like we were leading before Covid, we will miss the mark in this new era we are all experiencing.

Annual revenue: $44 million.

2023 goals: 6 new locations, double-digit comps over 2022 in existing locations, and exceed industry standards in all KPIs.

Growth meter: How do you measure your growth? Growth can truly be measured by the personal and professional growth achieved by each of the leaders in our company. At the end of the day, I want us to be a company that focuses on developing and training the individuals on our team. If they are individually successful and achieve new heights, we will be successful as a group!

Vision meter: Where do you want to be in 5 years? 10 years? I want to have successfully built a team of individuals who are able to work together cohesively to bring more success to our business than I was ever capable of doing myself. I believe we are more than well on our way to that goal. We have some really strong, key individuals who make up the foundation of our company. In 10 years, I see myself slowing down just a bit personally, but not as a company! I don’t think I am capable of slipping off into the sunset, aka retirement. I enjoy staying busy and working, and I’m confident that my team will help pull the wagon so my husband and I can spend more time traveling the world together. Our travel bucket list is long!

Do you have brands in different segments? Why/why not? Currently, no. I have weighed the pros and cons of diversifying into other brands. I know the coffee business inside and out. I know what it can and will do in a strong economy and a struggling economy. I know what it takes to succeed, and for that reason I have chosen at this time to put my energy into growing our Scooter’s Coffee business and dominating in the markets where we operate.

Are you experiencing economic growth in your market? In the past 2 to 3 years we have had really strong growth. While we are feeling the impact of the current economy,

we are still seeing daily, weekly, and monthly positive growth in our company.

How do changes in the economy affect the way you do business? It honestly doesn’t affect how we do business in our current locations. Our focus remains consistent, which is to provide an amazing experience for our customers consistently in each location. As far as new business development, an economic downturn can sometimes be the opportunity for us to capitalize on growth when others are slowing down or even pushing pause. I believe in our brand and the model of Scooter’s Coffee, so we intend to continue to press forward on all fronts.

How do you forecast for your business? With Covid producing some unique times in our world, and now with the economy slowing down, I forecast our sales for 2023 very conservatively. I feel confident that we will meet or exceed the forecasts I have in place, which provides confidence in our goals for the next year or two. Anything above my forecasts will just allow for bonus opportunities.

What are the best sources for capital expansion? For us, it is through partnership with our local bank, which we have had a long-term relationship with.

Experience with private equity, local banks, national banks, other institutions? Why/why not? We have a really strong partnership with our local bank. Mutual trust allows us to work together on future growth plans, and we intend to continue in this relationship for the foreseeable future.

How are you handling rising employee costs (payroll, minimum wage, healthcare, etc.)? We have a pretty competitive compensation and benefits package for our employees that includes salary, tips, bonuses, health care, dental/vision, short-term disability, life insurance, situational insurance, tuition reimbursement, and free coffee. However, we are constantly assessing and reviewing that package to remain competitive in our industry, and we anticipate additional benefits will be rolled out in 2023. On top of that, offering growth and development opportunities is a big part of what we offer our employees who demonstrate strength, leadership, and a willingness to learn.

I want to have successfully built a team of individuals who are able to work together cohesively to bring more success to our business than I was ever capable of doing myself. I believe we are more than well on our way to that goal. We have some really strong, key individuals who make up the foundation of our company.

The business of franchising is ever growing, with ever more franchisees shifting to multi-unit franchise ownership. As the U.S. economy emerges from the impacts of the Covid-19 pandemic, multi-unit operators have been thrown into the spotlight as franchise development shifted to focusing on experienced operators over onboarding new talent. With talks of recession, efforts on new ownership are likely to shift back again, as the economic slowdown creates new swathes of franchise candidates.

FRANdata has been producing the Mega 99 rankings for close to 20 years, leveraging our comprehensive database of franchisee information to provide thoughtful analysis and insights on the state of franchising. In 2022 we saw multi-unit ownership continue to gain traction, primarily because of the following factors.